Imagine you’re driving safely when, out of nowhere, another car cuts you off and suddenly stops, causing you to rear-end them. You’re shaken but try to stay calm. Then, things get strange—the other driver insists on handling the situation privately, or their injuries seem exaggerated.

Situations like this could be signs of insurance fraud car accidents, where scammers stage accidents to profit from fake claims. Here’s what you need to know to guard against insurance fraud and secure the compensation you deserve.

Types of Insurance Fraud Car Accidents

Insurance fraud in car accidents is any dishonest action taken to get a payout from an insurance company. Recognizing the signs of insurance fraud can help you steer clear of these schemes. Here are some common ways fraud can happen in car accident claims:

- Staged Accidents: Scammers cause or fake accidents to file false insurance claims.

- False Personal Injury Claims: People may claim serious injuries after a minor accident, even if they aren’t hurt.

- Exaggerated Damage Claims: Fraudsters inflate the costs of car repairs or claim damage that didn’t happen.

Common Tactics in Staged Accidents

Fraudsters use different tactics to make it look like an accident is your fault, often so they can claim money for fake injuries or damages. These staged accidents can be hard to spot because they’re made to look real.

Here are some of the most common ones:

The Panic Stop: A driver stops without warning to cause an accident, usually at a busy intersection or when traffic is flowing.

The Swoop and Squat: A scammer suddenly pulls in front of you, then slams on the brakes, causing a rear-end collision.

The Drive Down: Someone waves you forward, but then intentionally drives into you, claiming it was your fault.

Identify Potential Scams and Red Flags

In addition to the tactics above, here are more signs that could point to potential fraud schemes:

- Fake Witnesses: Scammers sometimes use accomplices who pretend to be witnesses to support their version of events, making it more difficult to contest their claim.

- Suspicious Behavior and Requests: If the other driver insists on settling without involving the police, tries to avoid insurance companies, or pressures you to sign documents, these are all red flags to be aware of.

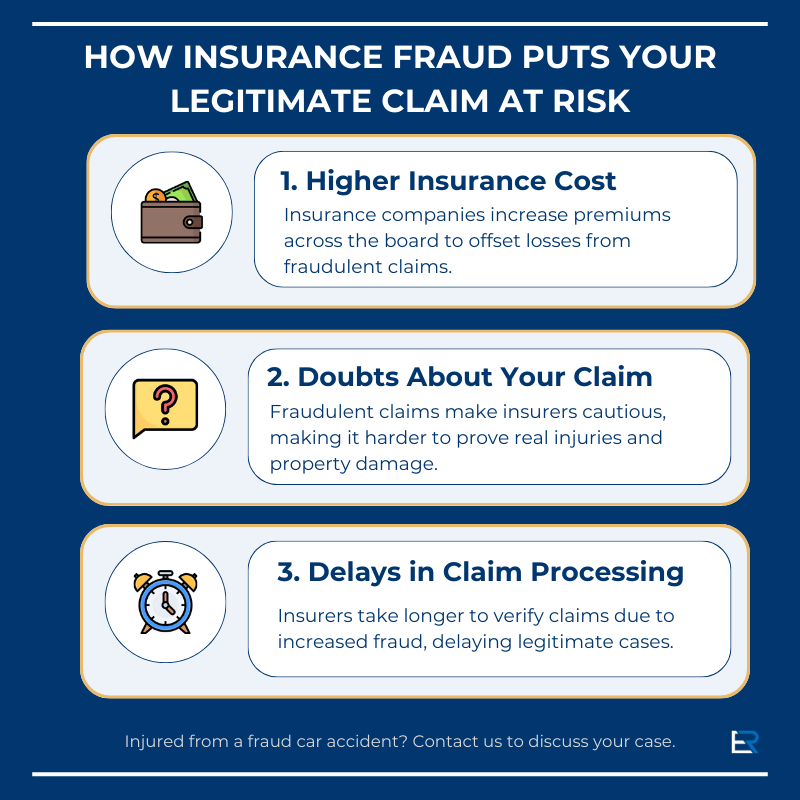

Why Insurance Fraud Matters for Your Legitimate Claim

When scammers file false accident claims, it doesn’t just affect insurance companies; it affects everyone. Dishonest claims affect legitimate drivers, making it harder to get the compensation you deserve.

Here are some impacts a fraudulent claim can have on your personal injury case:

- Higher Insurance Costs: Insurance companies may raise rates for everyone to cover fraudulent payouts.

- Delays in Processing Claims: With so many fake claims, insurers may take extra steps to verify claims, which means longer wait times—even if your claim is legitimate.

- Doubts about Your Injury or Damage Claim: Fraudulent claims make insurers more cautious, making it harder to prove real injuries and property damage.

What to Do After You Suspect A Fraudulent Accident

If you find yourself injured in an auto accident that seems suspicious, take these steps to protect your claim:

1. Seek Medical Attention

Even if your injuries seem minor, seek medical care promptly. A doctor’s evaluation helps document your injuries, which can protect you if fraud is suspected.

2. Document the Scene

Take photos and videos of the scene, including vehicle damage and visible injuries. Collect witness information to support your claim.

3. Confirm Identity of All Involved

Verify the other driver’s information against their ID and registration. Note any discrepancies.

4. File a Police Report

Always contact the police and have a report filed, even if the other party discourages it. A police report provides official documentation of the accident and can be critical in disputing fraudulent claims.

5. Report Promptly to Your Insurance Company

Notify your insurance company about the accident immediately. Quick reporting allows your insurer to start investigating, which can protect you if fraud is suspected.

6. Keep Detailed Records

Maintain records of medical bills, repair estimates, and communication with the other driver’s insurer to support your claim.

Recommended Reading: Los Angeles Rear-End Collision Injuries

How to Protect Yourself from Insurance Fraud Car Accidents

Taking proactive steps can help you avoid becoming a target for fraud. Here’s what you can do to stay safe on the road:

- Drive Defensively

Be alert and maintain a safe distance from other vehicles. Watch for erratic or aggressive drivers who may try to cause an accident. Avoid tailgating, stay focused, and drive cautiously, as fraudsters often target distracted drivers.

- Consider Installing a Dashcam

A dashcam can provide clear, unbiased evidence that makes it harder for fraudsters to make false claims. Dashcam footage can capture sudden stops, suspicious behaviors, and other important details to support your version of events if something does happen.

When to Contact a Personal Injury Attorney

If you’ve been injured in a suspected insurance fraud car accident, contacting an experienced personal injury attorney can make a big difference. Here’s how an attorney can support you after an injury involving potential fraud:

- Experience with Insurance Fraud Cases: We know how to identify red flags, collect evidence, and work with authorities to investigate fraudulent claims.

- Comprehensive Support for Every Step: From taking on the insurance companies to helping you gather documentation, we’re here to make sure your claim has the best chance of success.

- Committed and Passionate Representation: We’re dedicated to helping you get the compensation you deserve without unnecessary hassle.

Turn Confusion into Clarity—Reach Out Today

Don’t let insurance fraud impact your injury claim. Trust El Dabe Ritter Trial Lawyers to help you navigate the challenges of your claim. Our California personal injury lawyers have over two decades helping protect the rights of injured victims.

Contact us today if you have injuries and suspect insurance fraud from the other driver. Schedule your free consultation below!

Fill out our form today to schedule your free consultation and take the first step towards justice.